Simply put, it has a low chance of appeal after you’ve received the denial, thus you lose money.

#Timely filing for humana code

Submitting a claim past an insurance's timely filing limit will come back to you as Claim Adjustment Reason Code (CARC) 29 and state, “The time limit for filing has expired.”ĬARC 29 has a high chance of prevention but a low overturn rate. Claims correction: Correct a claim thats. First Health Plans only accepts one member and one provider. On the flipside, if your team isn't familiar with the limits for the insurances the majority of your patients use, you're losing revenue. Claim submission: Submit individual claims through the Portal user interface or multiple claims via a batch file. Claims must be submitted within the timely filing timeframe specified in your contract. Knowing the deadlines of payers that attribute to most of your revenue before your patients visit your office will help your team anticipate and submit your claims faster. Why not use it as a guide to help identify the most important timely filing limits your team should be aware of? It's helpful in breaking down what percentage of revenue comes from common insurances. When speaking to our clients, most of them know their payer mix.Ī payer mix is a listing of the different healthcare insurances your patients use. Proof of Timely Filing Medicare Advantage Providers: Timely filing of a Primary Claim: All claims (electronic or paper) for services rendered after Janumust be submitted within one (1) year from the date of service. But which are they actually using? Of course, I'm referring to what's known within the industry as a "payer mix." timely filing can be demonstrated according to the Proof of Timely Filing guidelines. 28 Provide that the subcontractor adhere to LDHs timely filing guidelines as. There are hundreds of thousands of insurance options your patients can choose from. As we do in other Medicaid states, Humana will hold every subcontractor to. Some of those responsibilities include patient care, coding, and keeping track of healthcare requirements.Įnsuring your team is submitting patient claims on time is another important responsibility you need to know. Better Care Management Better Healthcare Outcomes. With a small amount of extra effort, you can lower your timely filing denial rate even more.Ĭhances are, you and your staff already have a ton of work to complete on a daily basis. Doctors helping patients live longer for more than 25 years. As a simple example for reference, 0.01% of $3,000,000 is $30,000.įurthermore, that percentage is only true if you have all of those payers and submit an equal amount of claims to each. If the deadline isn’t 180 or 365 days then there’s a 56% chance that the limit is 90 daysīy submitting your claims within 90 days the chances that you receive a claim denial related to timely filing is 0.01%.Ī 0.01% chance stacks the odds in your favor, although that percentage can still have a significant negative effect on your bottom line if you aren't vigilant. Submit billing to CareCentrix at least monthly and within timely filing requirements at the designated address for claims and submit no billing to the. If the deadline isn’t 180 days then there is a 46% chance that their limit is 365 days Now, you have fixed the problem and resubmitted it with the correct info, but the carrier.

Effective for dates of service and after, Aetna will revert to the standard contractual. For example, you may have submitted a claim in the proper time frame and it was denied for a reason such as incorrect ID, patient’s name was misspelled, or it was originally sent to the wrong insurance carrier.

#Timely filing for humana manuals

State-specific Medicaid provider manuals (sometimes referred to as appendices) also are available and may contain additional information.

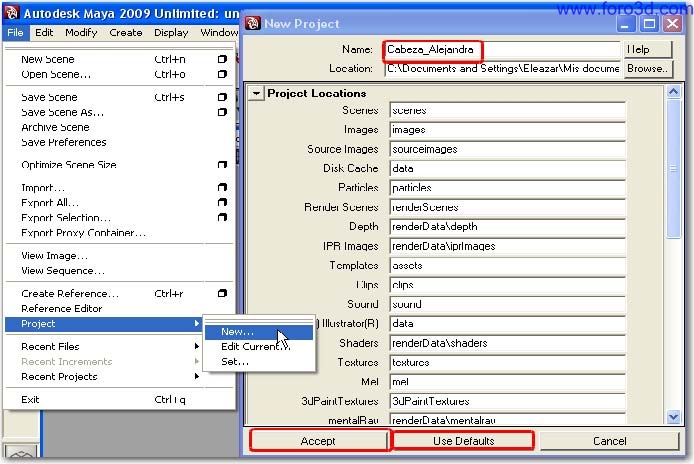

Other policies and procedures are posted online. There is a 34% chance that an insurance company has a deadline of 180 days In 2019etna A Better Health made an exception for the timely filing of o riginal claims and allowed for dates of s ervice incurred in 2019 to be filed within 365 days of the date of s ervice or by, whichever date was earlier. Humana, ChoiceCare and HBHN policies and procedures, claims submission and adjudication requirements and guidelines used to administer Humana health plans. The two most popular timeframes are 180 days and 360 days If claims are submitted after this time frame, they will most likely be denied due to timely filing and thus, not paid.From the bar graph and statistical data above we can conclude that… The following table outlines each payers time limit to submit claims and corrected claims.

0 kommentar(er)

0 kommentar(er)